To make this easier, many accounting software solutions will let you go back in time and see what your AP balance was at different points.

Instead, look at your high and your low across the month. If your AP balance changes a lot between the beginning and end of the month, don’t just look at the first 5 days or the last 5 days. The important thing is to make sure the time period you choose is as “typical” for your company as possible. If you run a small business and you don’t have an internal finance team, your accountant can calculate your accounts receivable turnover ratio and other key financial ratios for you.Ĭompanies that have busy AP departments with many bills and payments often start by looking at their AP turnover over a 5-day or 10-day period. You can find your AP balance on your balance sheet, a key financial statement for all companies. Divide the total payments by your average AP balance.Calculate your average AP balance over the same time period.

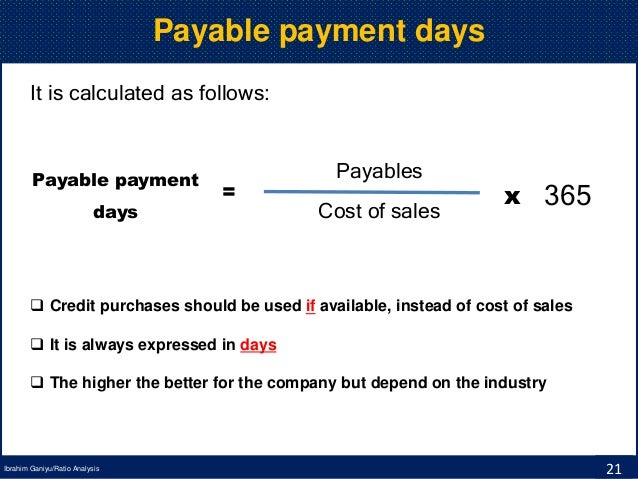

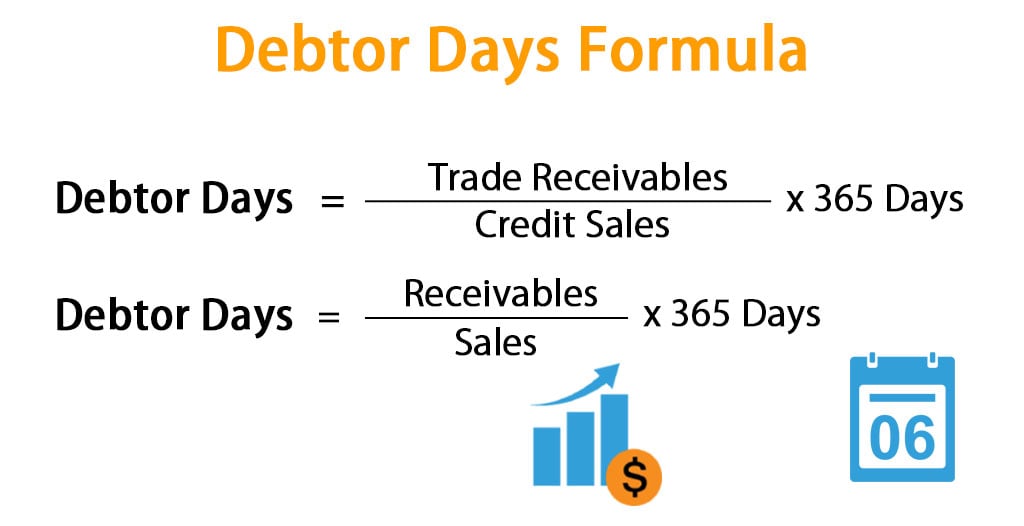

Add up the payments you made on your accounts payable during that time.Decide on the time period you want to look at.Specifically, your payable turnover ratio measures the number of times you pay out your average AP balance over a given time period. But AP turnover goes deeper than that.īy factoring in your average AP balance, not just your total payables, AP turnover measures whether you’re staying right on top of your payables or letting that total creep upward. How do you calculate accounts payable turnover?Īt first glance, it might sound like any company that’s paying its bills on time will have a one-to-one ratio between obligations and outflows - it’s paying as much as it owes. Large suppliers may also use it if they’re considering letting your business pay over time.Banks and credit card companies can use it to decide whether they’re willing to offer a line of credit, and on what terms.Corporate finance teams can also use it as an early warning sign of cash flow problems, making sure they’ll have enough cash to meet their short-term obligations.It’s a good measure of short-term liquidity and your company’s financial condition. Companies can track their AP turnover rate to make sure they’re paying their bills on time.It looks specifically at the AP account in your company’s accounts. What is accounts payable turnover?Īccounts payable turnover is an accounting metric that compares the payments you made on your accounts payable (AP) to your average AP balance during a given time period.

#Ap turnover days how to

This article lays out what accounts payable turnover is, how to measure it, and why today’s metric-savvy accounting teams keep such a close eye on it. It measures how quickly a business makes payments to creditors and suppliers. It does not store any personal data.A company's accounts payable turnover rate is a a key measure of back-office efficiency and financial health. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other.

The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly.

0 kommentar(er)

0 kommentar(er)